SEC vs Coinbase (and all), Binance & CZ Sued, MicroStrategy pockets more Bitcoin and More!

This week’s issue covers events from 21 March to 27 March 2023.

📣 Welcome to The Web3 Digest!

Join our weekly newsletter for in-depth analysis and commentary on the biggest news and events in Web3.

TL;DR:

Binance & CZ confronted with CFTC lawsuit

Texas aims to become a Bitcoin business hub

Australian regulators increase scrutiny on banks and crypto

Telegram now supports Tether (USDT) transfers

UAE announces its Central Bank Digital Currency strategy

SEC takes action against Justin Sun & Coinbase

Arbitrum Token records $2 billion trading volume in one day

Bitcoin mining difficulty reaches a new peak

Celebrities face repercussions for promoting crypto

G-7 countries to intensify global crypto regulations

MicroStrategy settles loan & acquires more Bitcoin

Investments in European DeFi startups surge

📕 This Week's Cover Story

SEC vs Coinbase (and virtually everyone): A Legal Showdown Shaping the Future of Crypto

Legal Battle Looms Over Crypto Regulations

Coinbase, the largest crypto exchange in the United States, is gearing up for a legal battle with the Securities and Exchange Commission (SEC). The SEC has issued a Wells Notice to Coinbase, claiming that the exchange violates US securities laws. While not a formal lawsuit, the Wells Notice typically precedes one. This case could set the stage for a precedent-setting case in the cryptocurrency industry.

A Defining Moment for Crypto

Former SEC attorney Marc Fagel believes that this legal battle could provide much-needed clarity on whether all digital assets, except Bitcoin, are unregistered securities. A ruling, in this case, could settle the long-standing debate once and for all.

Coinbase's Stance: A Call for Fair Treatment

Coinbase Chief Counsel Paul Grewal and CEO Brian Armstrong welcome the opportunity to defend the company's approach to crypto asset listings in court. They assert that the SEC has not been fair or reasonable in its engagement with digital assets. Coinbase reasserts that it does not list securities or offer products to customers that are securities.

The Existential Question: Commodity or Security?

Classifying crypto assets as commodities or securities is critical for the industry. Securities are subject to strict and expensive oversight, which could potentially hinder the growth of emerging companies. Confusion around this issue is widespread, and Congress has yet to provide legislative clarity.

Coinbase's Push for a Regulatory Framework

Coinbase claims that the SEC has ignored its attempts to create a framework for digital assets. The company developed and proposed two registration models, spending millions on legal support and seeking the SEC's feedback, which was never provided.

A Demand for Clear Rules and Registration Path

Coinbase insists that if the SEC provides a clear set of rules and an actual path to registration, they will comply. The resolution of any potential lawsuit could take years, but some clarity regarding the status of crypto assets may be on the horizon.

Coinbase Spearheads Crypto Regulations

Coinbase is not alone in its quest for new laws and regulations for crypto. The company spent nine months attempting to engage the SEC in discussions about crypto regulations and breaking new ground. As the tension between crypto proponents and regulators grows, this legal showdown could catalyze much-needed change in the industry.

The Conclusion: An Industry at a Crossroads

The impending legal battle between Coinbase and the SEC marks a crucial moment for the future of cryptocurrencies. As the case unfolds, it will provide insights and establish new regulations shaping the crypto landscape for years to come.

Stay tuned and follow us on Twitter as we follow this groundbreaking story.

More of This Week's Top Stories

⛏️ Bitcoin mining difficulty reaches a new peak

Bitcoin's mining difficulty rose by 7.56%, hitting a record high alongside the network's hash rate. This demonstrates that miners are dedicating more computational resources to the network.

📱 Telegram now supports Tether (USDT) transfers

Telegram users can now send each other tether (USDT), the largest stablecoin by market cap, within the chat application, simplifying peer-to-peer transactions.

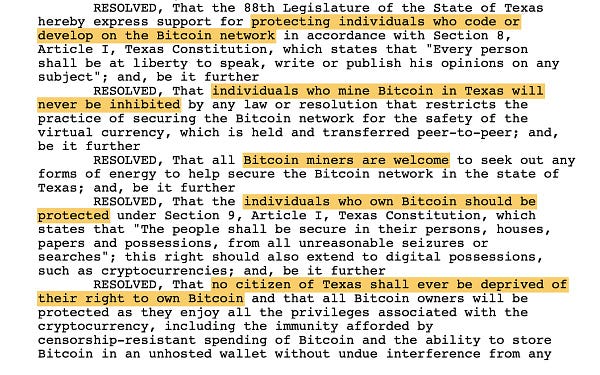

💼 Texas aims to become a Bitcoin business hub

The Texas legislature has proposed a bill to attract more Bitcoin-related enterprises to the state and protect the rights of Bitcoin users, miners, and developers.

🌟 Celebrities face repercussions for promoting crypto

US regulators have recovered funds earned by celebrities such as actress Lindsay Lohan and boxer Jake Paul for promoting cryptocurrencies. This is part of an ongoing effort to hold public figures accountable for endorsing digital assets violating investor protection laws.

🇦🇺 Australian regulators increase scrutiny on banks and crypto

Australia's Prudential Regulation Authority (APRA) reportedly requires banks to disclose their exposure to startups and crypto-related businesses daily, indicating heightened scrutiny in the sector.

🏛️ Binance & CZ confronted with CFTC lawsuit

Binance Holdings Ltd. and CEO Changpeng Zhao (CZ) are facing a lawsuit filed by the US Commodity Futures Trading Commission (CFTC) over alleged violations of trading and derivatives regulations. The lawsuit was submitted in a federal court in Chicago.

💻 UAE announces its Central Bank Digital Currency strategy

The Central Bank of the United Arab Emirates has revealed its Central Bank Digital Currency (CBDC) strategy, "The Digital Dirham," marking a significant step in the country's digital finance efforts.

🚨 SEC takes action against Justin Sun & Coinbase

The US Securities and Exchange Commission (SEC) has charged Justin Sun with selling and airdropping unregistered securities, fraud, and market manipulation. Coinbase received a Wells notice from the SEC in a separate case, indicating the regulator's intention to enforce action against the largest US cryptocurrency exchange.

🚀 Arbitrum ($ARB) records $2 billion trading volume in one day

Arbitrum Native Token ($ARB) witnessed an impressive trading volume of over $2 billion within just 24 hours of going live, showcasing strong market interest in the token.

📈 Investments in European DeFi startups surge

In 2022, European decentralized finance (DeFi) startups raised $1.2 billion, representing a 120% increase compared to the previous year's investment of $534 million. This highlights the growing interest and confidence in the European DeFi ecosystem.

🌍 G-7 countries to intensify global crypto regulations

The Group of Seven (G-7) nations are working to strengthen global crypto regulations, focusing on enhancing business transparency and safeguarding consumer protection in the rapidly evolving space.

💰 MicroStrategy settles loan & acquires more Bitcoin

MicroStrategy has prepaid the remaining principal on its $205 million loan from the now-defunct, crypto-focused Silvergate Bank. Additionally, the company announced the purchase of another 6,455 bitcoins for approximately $150 million.

Stay Ahead of the Curve with The Web3 Digest

That's it for this week's edition of The Web3 Digest!

Stay tuned for next week's newsletter to keep up with the latest news, events, and developments in the Web3 space.

If you enjoyed this issue, don't forget to subscribe and share it with your friends, colleagues, and fellow Web3 enthusiasts. Your support helps us continue providing valuable content and analysis to keep you informed and engaged.

Follow us on Twitter and LinkedIn for real-time updates and insights.

Looking forward to seeing you in our next issue!